Understanding the Essentials of a Hard Cash Loan: What You Required to Know Before Using

Navigating the complexities of difficult cash financings calls for a clear understanding of their basic qualities and implications. These lendings, usually leveraged genuine estate financial investments, prioritize property value over customer debt, providing both substantial threats and unique benefits. As one considers this funding choice, it is necessary to evaluate the advantages against the possible mistakes, particularly pertaining to rates of interest and settlement terms. What vital elements should you examine prior to making such a vital financial decision? The answers might be more consequential than you expect.

What Is a Tough Money Loan?

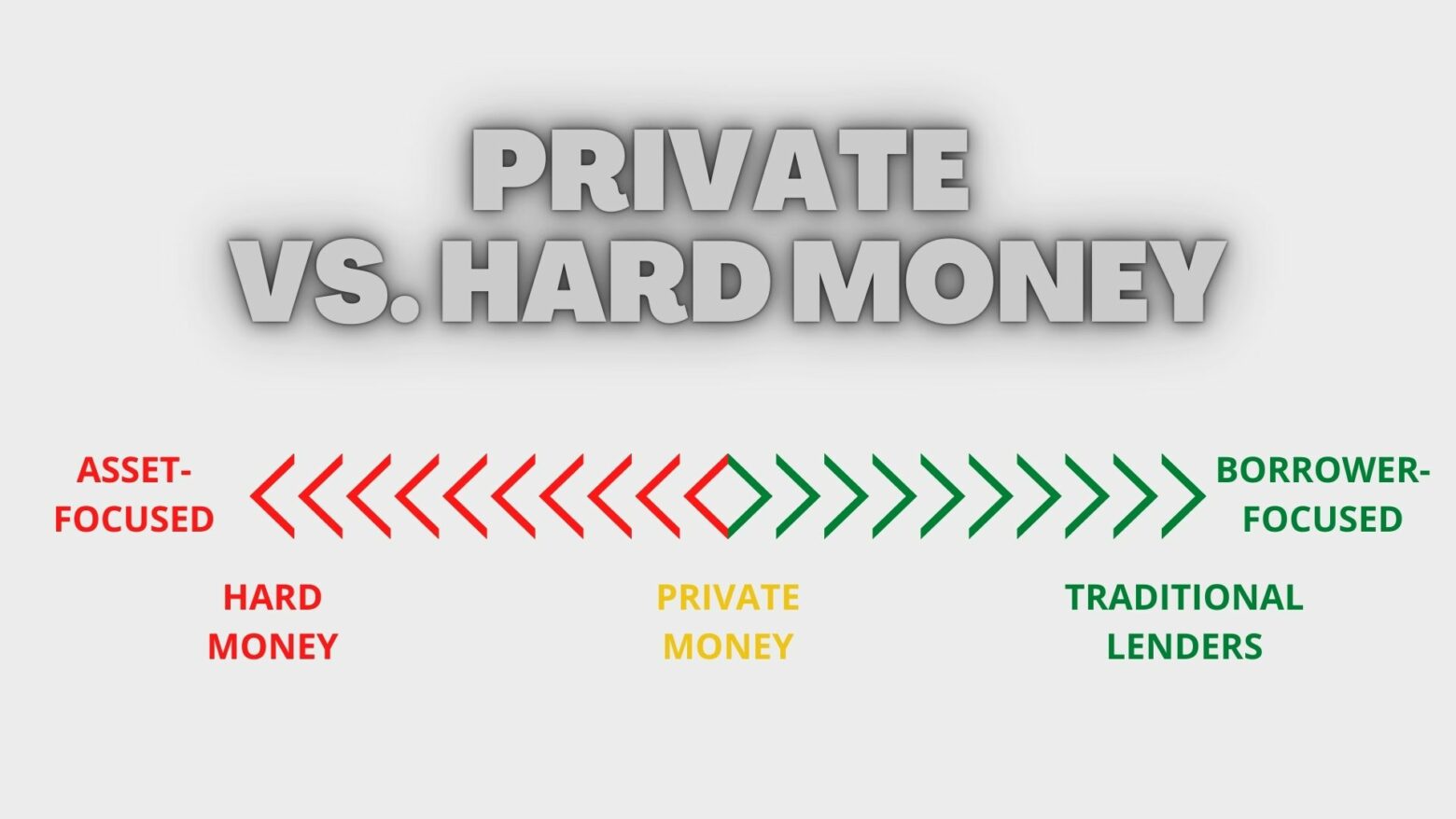

A hard cash financing is a type of short-term financing safeguarded by real estate, normally utilized by programmers and investors. Unlike traditional finances that count heavily on the borrower's creditworthiness, tough cash car loans are primarily analyzed based upon the value of the building being made use of as security. This makes them an attractive alternative for those that might not receive standard funding due to bad credit rating or immediate funding requirements.

These fundings are normally provided by personal lenders or investment groups, and they commonly come with higher rate of interest prices compared to typical home mortgages. The reasoning behind these raised rates hinges on the raised threat that loan providers assume, provided the brief period and possible volatility of the property market. Hard cash lendings normally have terms ranging from a couple of months to a few years, making them perfect for fast transactions such as property flips or immediate renovations.

Exactly How Tough Cash Car Loans Job

Recognizing the technicians of hard money fundings is critical for investors looking for fast financing services. Unlike traditional finances that count heavily on credit rating and revenue confirmation, tough money loans are asset-based. This implies that loan providers concentrate primarily on the value of the home being financed instead of the debtor's monetary background.

The procedure commonly starts with a car loan application, where the customer supplies details concerning the building, including its value and the intended use of funds - hard money georgia. Upon assessment, the lender analyzes the building's worth, typically requiring a specialist appraisal. If approved, the financing amount is usually a portion of the property's value, commonly ranging from 60% to 80%

Benefits of Difficult Cash Car Loans

Hard cash financings provide a number of benefits that can be particularly beneficial for real estate financiers. One of the most significant benefits is the rate at which these finances can be gotten. Unlike conventional funding, which often entails prolonged approval procedures, hard cash finances can be safeguarded promptly, enabling financiers to take advantage of time-sensitive possibilities.

An additional benefit is the adaptability in browse around this web-site underwriting standards - hard money georgia. Hard money lending institutions typically focus on the worth of the residential or commercial property as opposed to the debtor's creditworthiness, making it easier for capitalists with less-than-perfect credit rating to qualify. This enables greater ease of access to funds, specifically for those aiming to renovate or flip buildings

Additionally, tough cash finances can give considerable funding amounts, which can empower financiers to carry out larger jobs. The short-term nature of these finances motivates effectiveness, as consumers are motivated to complete their projects swiftly to repay the lending.

Last but not least, hard cash financings can be a tactical device for financiers seeking to utilize buildings, enabling them to reinvest earnings right into brand-new chances. Generally, these benefits make difficult cash fundings a valuable funding alternative for genuine estate financiers browsing open markets.

Considerations and threats

One significant threat is the high-interest rates associated with hard money lendings, which can vary from 8% to 15% or even more. These elevated prices can severely influence the total profitability of a real estate financial investment. Additionally, tough money loans often feature shorter payment terms, usually lasting from a couple of months to a couple of years, calling for investors to have a clear exit method.

Another factor to consider is the dependence on the security's worth instead of the borrower's credit reliability. This indicates that if property values decline or if the task encounters unforeseen delays, capitalists might encounter considerable monetary strain or perhaps repossession.

The Application Process

Browsing the application process for difficult cash financings calls for cautious focus to detail, especially after thinking about the linked dangers. The very first step is to identify a reputable tough cash lender, as the quality of your lender can dramatically affect the terms of your funding. Study prospective lenders, review their online reputation, and ensure they are transparent concerning their fees and processes.

Once you have selected a loan provider, you will certainly need to gather needed paperwork. This generally consists of a financing application, residential property details, financial statements, and a departure method detailing exactly how you prepare to pay back the financing. Tough cash lending institutions focus on the possession's value over the debtor's credit reliability, so check it out a complete building evaluation is often called for.

After sending your application, expect a quick evaluation process. Difficult money lendings generally have much shorter approval times than traditional fundings, typically within a few days. If accepted, the lender will detail the terms, consisting of rate of interest and payment timetables. It's important to carefully examine these terms before authorizing any contracts to guarantee you comprehend your financial obligations completely. With due persistance, you can simplify the application procedure and protect the funding you require.

Final Thought

In final thought, an extensive understanding of hard cash fundings is necessary for possible consumers. These fundings, identified by their dependence on actual estate worth instead than credit reliability, deal distinct benefits such as fast accessibility to capital and flexible terms.

A hard cash funding is navigate here a type of temporary funding protected by real estate, usually used by capitalists and programmers. Unlike standard financings that count greatly on the customer's credit reliability, difficult money financings are primarily analyzed based on the worth of the residential or commercial property being made use of as collateral. Unlike traditional financings that depend greatly on credit scores and earnings confirmation, difficult cash finances are asset-based. The first step is to identify a reliable tough money lender, as the quality of your lending institution can dramatically affect the terms of your funding. Hard money fundings generally have much shorter approval times than typical car loans, frequently within a couple of days.

Comments on “Hard Money Georgia: Unlocking Opportunities for Property Developers”